Three years ago, I made a video called “8 Financial Habits That Made Me a Millionaire.” A lot has changed since then.

I now own real estate in the U.S.

My kids have started school

My investment income caught up with my business income — a bittersweet milestone

But the biggest shift?

I stopped thinking like an entrepreneur… and started thinking like an investor.

So here’s 8 habits that got me here

(and are still working 👇)

Track everything

I treat budgeting and spreadsheets as a form of meditation. Every month, I sit down and review:

All business profits/losses

Expenses per product and per platform

Investment performance

Tax payments, upcoming renewals, etc.

If you can’t measure it, you can’t manage it. This habit changed everything.

Delegate to grow

One of my favorite hiring principles — something I picked up from a conversation with Reid Hoffman:

Hire people you’d want to work for.

I focus on the stuff only I can do — and let my team do the rest.

Generally, I look for people I can learn from — people who take initiative and think like entrepreneurs.

Build your investment system, then get out of the way

Treat investing like a second job but only at first. Learn the basics, set up a system that works for you (yes, AI can help), and then — automate and forget.

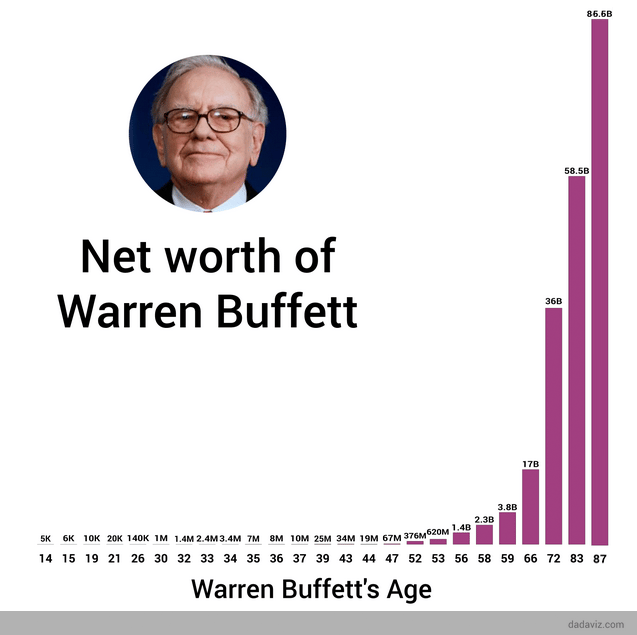

Warren Buffett is the perfect example.

His net worth didn’t skyrocket overnight — most of it came decades after he started investing.

If you set aside $10,000 today, the real magic happens in 20–30+ years.

What matters early:

Understanding leverage (mortgages aren’t always “bad” debt)

Diversifying income streams

Studying how wealthy people use credit

And yes… crypto. I now keep up to 5% of my portfolio in Bitcoin ETFs.

Know your “freedom number”

Want a jet? A cottage? Just peace? Cool.

Write it down. Get clear on how much your dream life actually costs.

Spoiler: It’s probably less than you think.

Use life hacks that actually pay off

In the U.S., credit cards with miles are game-changing. All our business expenses go through cards with generous travel rewards.

That’s how we fly business class with points — and save thousands every year.

Stay liquid, but don’t let money sit

Keep part of your capital accessible — but never idle.

Even operational cash can earn 4–5% interest today.

Talk to your financial advisor about where to park funds short-term (e.g. money market funds or high-yield accounts).

I use Fidelity for my corporate accounts.

Don’t ignore crypto — but don’t bet the house

In the past, my advisor told me: “1% max.”

Now, he says: “Let’s go up to 5%.”

That doesn’t mean gambling on random coins. It means allocating a small, calculated slice of your portfolio to emerging trends — like Bitcoin ETFs or ETH.

Small risks, big learning curve.

Renting isn’t failure

Let’s stop romanticizing home ownership.

In big cities like SF, LA, or NYC, renting can be way smarter than buying — especially when mortgage + taxes = 3x your rent price.

Instead of stressing over a mortgage just for “status,” consider buying investment properties (like Airbnb units) — and renting where you actually want to live.

Money is not the goal.

Freedom is.